Property Tax Whitley County Indiana . The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. The whitley county treasurer offers several convenient options to make real and personal property tax payments. Online access to maps, real estate data, tax information, and appraisal data. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax. Simply type the address in the search box below to perform a quick property tax lookup. Looking for property tax information on a specific home? The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of.

from www.dochub.com

Online access to maps, real estate data, tax information, and appraisal data. Looking for property tax information on a specific home? The whitley county treasurer offers several convenient options to make real and personal property tax payments. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax. The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. Simply type the address in the search box below to perform a quick property tax lookup. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of.

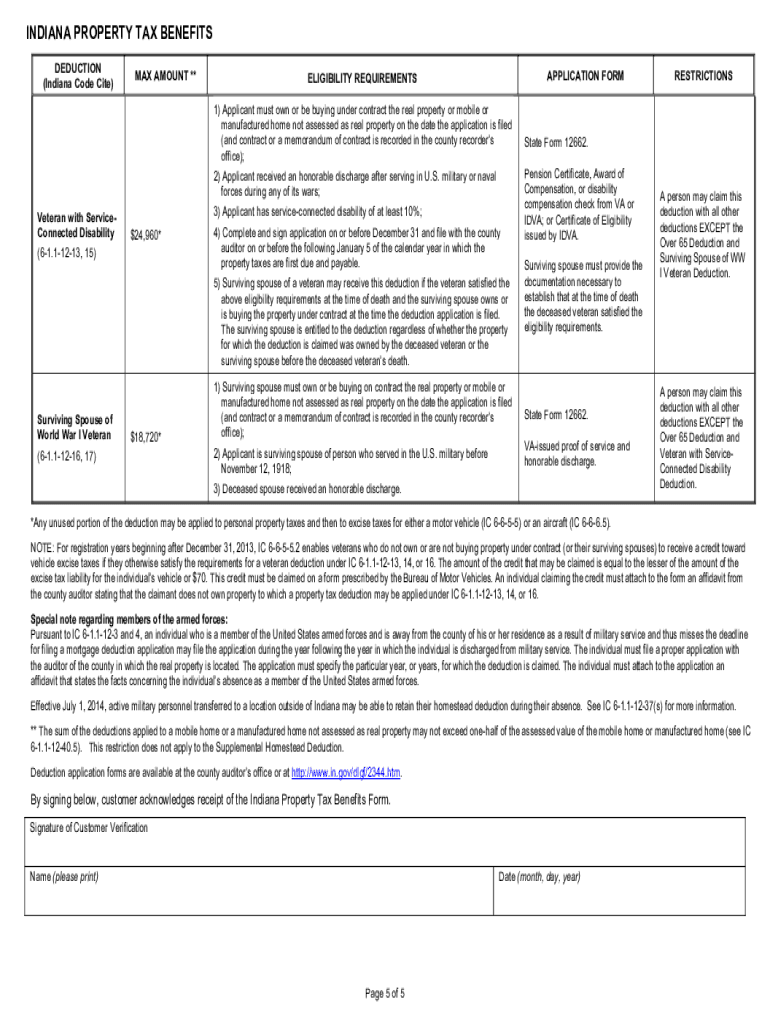

Indiana property tax benefits Fill out & sign online DocHub

Property Tax Whitley County Indiana The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. Simply type the address in the search box below to perform a quick property tax lookup. Looking for property tax information on a specific home? The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. Online access to maps, real estate data, tax information, and appraisal data. The whitley county treasurer offers several convenient options to make real and personal property tax payments. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax.

From www.formsbank.com

Indiana Property Tax Benefits Form printable pdf download Property Tax Whitley County Indiana Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. Online access to maps, real estate data, tax information, and appraisal data. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. The whitley county treasurer. Property Tax Whitley County Indiana.

From www.beforetime.net

Indiana Township Plat map of Marion County, Iowa Property Tax Whitley County Indiana To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax. Simply type the address in the search box below to perform a quick property tax lookup. Looking for property tax information on a specific home? The median property tax (also known. Property Tax Whitley County Indiana.

From www.mappingsolutionsgis.com

Whitley County Indiana 2020 Aerial Wall Map Mapping Solutions Property Tax Whitley County Indiana The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Online access to maps, real estate data, tax information, and appraisal data. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. Search our extensive database of. Property Tax Whitley County Indiana.

From www.landsofamerica.com

2.06 acres in Whitley County, Indiana Property Tax Whitley County Indiana Simply type the address in the search box below to perform a quick property tax lookup. The whitley county treasurer offers several convenient options to make real and personal property tax payments. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. The median property tax (also known as real. Property Tax Whitley County Indiana.

From www.mappingsolutionsgis.com

Whitley County Indiana 2020 Wall Map Mapping Solutions Property Tax Whitley County Indiana The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. The whitley county treasurer offers several convenient options to make real and personal property tax payments. To verify what your property tax bill is or to verify that a tax payment has been made, visit the. Property Tax Whitley County Indiana.

From www.mapsales.com

Whitley County, IN Zip Code Wall Map Basic Style by MarketMAPS Property Tax Whitley County Indiana The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax. The whitley county treasurer offers several convenient options to make real and. Property Tax Whitley County Indiana.

From www.etsy.com

Whitley County Indiana 1873 Old Wall Map Reprint With Etsy Property Tax Whitley County Indiana To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to look up your tax. The whitley county treasurer offers several convenient options to make real and personal property tax payments. Search our extensive database of free whitley county residential property tax records by address, including. Property Tax Whitley County Indiana.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Whitley County Indiana Online access to maps, real estate data, tax information, and appraisal data. The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. The whitley county treasurer offers several convenient options to make real and personal property tax payments. Looking for property tax information on a specific home? The median property tax. Property Tax Whitley County Indiana.

From www.landsofamerica.com

2.1 acres in Whitley County, Indiana Property Tax Whitley County Indiana The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. To verify what your property tax bill is or to verify that a tax payment has been. Property Tax Whitley County Indiana.

From whitleycountyin.org

Whitley County, Indiana 1889 Plat Map Index & Images Township Maps Property Tax Whitley County Indiana Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. Simply type the address in the search box below to perform a quick property tax lookup. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of.. Property Tax Whitley County Indiana.

From tedshideler.com

The Whitley County, Indiana Courthouse (1890) Ted Shideler Property Tax Whitley County Indiana The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Simply type the address in the search box below to perform a quick property tax lookup. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page to. Property Tax Whitley County Indiana.

From www.dochub.com

Indiana property tax benefits Fill out & sign online DocHub Property Tax Whitley County Indiana Online access to maps, real estate data, tax information, and appraisal data. Simply type the address in the search box below to perform a quick property tax lookup. The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. The whitley county treasurer offers several convenient options to make real and personal. Property Tax Whitley County Indiana.

From www.mapsofworld.com

Whitley County Map, Indiana Property Tax Whitley County Indiana The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. The whitley county treasurer offers several convenient options to make real and personal property tax payments. The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Looking. Property Tax Whitley County Indiana.

From www.landsofamerica.com

5.28 acres in Whitley County, Indiana Property Tax Whitley County Indiana Online access to maps, real estate data, tax information, and appraisal data. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. To verify what your property tax bill is or to verify that a tax payment has been made, visit the whitley county gis page. Property Tax Whitley County Indiana.

From raogk.org

Whitley County, Indiana Genealogy Guide Property Tax Whitley County Indiana Simply type the address in the search box below to perform a quick property tax lookup. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax.. Property Tax Whitley County Indiana.

From wcsdky.com

Taxes Whitley County Sheriff Department Property Tax Whitley County Indiana The treasurer's office performs the billing and collection of property taxes and special assessments on real estate, personal property. Online access to maps, real estate data, tax information, and appraisal data. The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. To verify what your property. Property Tax Whitley County Indiana.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Property Tax Whitley County Indiana Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. The whitley county treasurer offers several convenient options to make real and personal property tax payments. Looking for property tax information on a specific home? The median property tax (also known as real estate tax) in whitley county is $1,023.00. Property Tax Whitley County Indiana.

From www.landsofamerica.com

3.64 acres in Whitley County, Indiana Property Tax Whitley County Indiana The median property tax (also known as real estate tax) in whitley county is $1,023.00 per year, based on a median home value of. Search our extensive database of free whitley county residential property tax records by address, including land & real property tax. Simply type the address in the search box below to perform a quick property tax lookup.. Property Tax Whitley County Indiana.